louiskessell4

About louiskessell4

Personal Loans for Bad Credit: A Lifeline For Financial Restoration

In in the present day’s quick-paced world, monetary emergencies can come up unexpectedly, leaving individuals in dire want of funds. For those with bad credit score, accessing a personal loan can feel like an uphill battle. Nonetheless, understanding the choices accessible and the steps to take can provide a lifeline for many in search of to rebuild their financial stability.

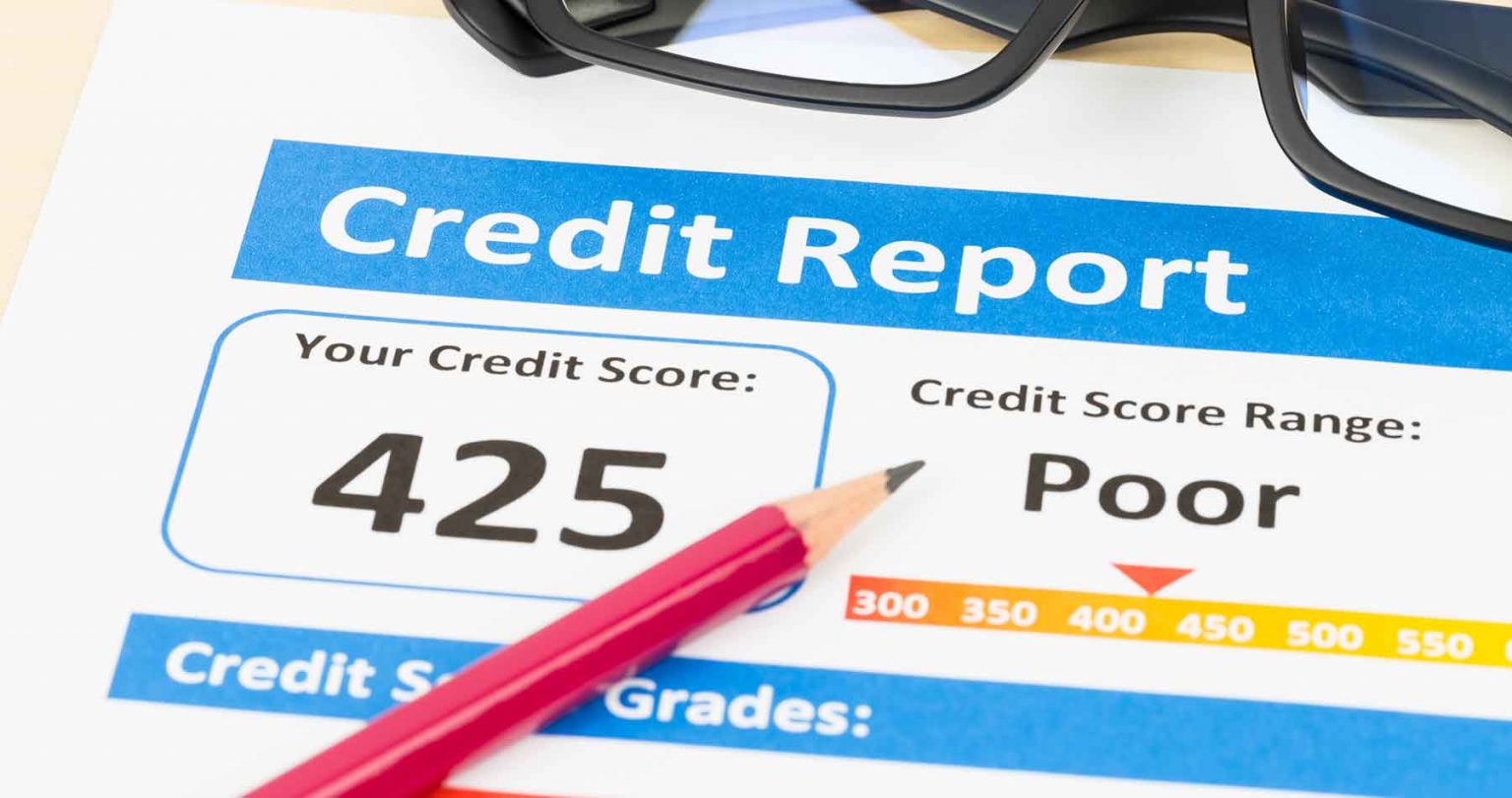

Understanding Bad Credit score

Bad credit score usually refers to a credit score rating that falls below 580 on the FICO scale. Elements contributing to a low credit rating include missed funds, high credit score utilization, defaults, and bankruptcies. These elements can create a vicious cycle; individuals with bad credit score usually struggle to safe loans, which can further hinder their potential to improve their monetary scenario.

The Significance of Personal Loans

Personal loans can serve as a invaluable useful resource for people dealing with monetary challenges. Unlike secured loans, which require collateral, personal loans are usually unsecured, meaning they do not require the borrower to pledge property. This feature makes personal loans interesting to these with unhealthy credit score who could not have worthwhile property to offer as collateral.

Forms of Personal Loans for Bad Credit

- Peer-to-Peer Lending: This relatively new model connects borrowers instantly with particular person lenders by on-line platforms. Peer-to-peer lending can supply extra versatile terms and decrease curiosity rates than conventional banks, making it an attractive option for those with unhealthy credit score.

- Credit score Union Loans: Credit unions usually have extra lenient lending standards than traditional banks. Members could have access to personal loans with lower interest rates and more favorable repayment terms. Moreover, credit unions typically prioritize group welfare over revenue, making them more prepared to work with borrowers going through monetary difficulties.

- On-line Lenders: Quite a few on-line lenders specialize in providing loans to people with dangerous credit score. These lenders typically utilize alternative knowledge to assess creditworthiness, which might consequence in additional favorable phrases for borrowers. Nevertheless, it is crucial to analysis these lenders completely, as curiosity charges and fees can differ considerably.

- Secured Personal Loans: For these with unhealthy credit score, offering collateral could improve the probabilities of loan approval. Secured personal loans require the borrower to pledge an asset, akin to a automobile or financial savings account. While this selection carries the risk of losing the asset if the loan is not repaid, it may possibly provide access to bigger loan quantities and lower curiosity rates.

Steps to Safe a Personal Loan with Bad Credit score

- Examine Your Credit score Report: Before making use of for a loan, it is important to assessment your credit score report for errors or inaccuracies. Correcting any discrepancies can improve your credit rating and enhance your possibilities of loan approval.

- Determine Your Price range: Assess your monetary scenario to find out how a lot you can afford to borrow and repay. Lenders will consider your debt-to-revenue ratio, so it’s essential to have a clear understanding of your monetary obligations.

- Analysis Lenders: Take the time to compare varied lenders and their choices. Search for these specializing in loans for individuals with unhealthy credit and consider their curiosity rates, charges, and repayment phrases.

- Collect Required Documentation: Lenders typically require documentation to process your loan application. This may increasingly embody proof of earnings, employment verification, and identification. Having these paperwork prepared can expedite the appliance course of.

- Consider a Co-Signer: If doable, having a co-signer with good credit can significantly improve your probabilities of loan approval. A co-signer agrees to take responsibility for the loan in the event you default, providing the lender with added safety.

- Apply for the Loan: Upon getting chosen a lender and gathered the necessary documentation, you may submit your loan application. Be prepared for the lender to conduct a hard inquiry in your credit score report, which may temporarily affect your rating.

- Evaluate the Loan Phrases: If approved, carefully evaluate the loan settlement before signing. Concentrate to the curiosity price, repayment terms, and any charges related to the loan. Ensure that you’re comfortable with the phrases before proceeding.

Managing Your Loan Responsibly

Once you have secured a personal loan, it is important to manage it responsibly. Making well timed payments is essential for rebuilding your credit score score. Set up automatic funds or reminders to ensure you do not miss any due dates. In case you encounter monetary difficulties, communicate with your lender as soon as possible to debate potential solutions.

The Impact of Personal Loans on Credit score

Taking out a personal loan can have a constructive affect on your credit rating if managed responsibly. By making on-time funds, you possibly can display your creditworthiness, which can enhance your rating over time. Moreover, diversifying your credit mix by adding a personal loan also can positively affect your credit profile.

Conclusion

Navigating the world of personal loans with unhealthy credit score might be difficult, however it’s not unimaginable. With the correct data and proactive steps, individuals can safe the monetary assistance they need to overcome challenges and work in direction of rebuilding their credit. If you have any questions regarding where by and how to use Personal loans For bad credit scores, you can contact us at our own web-site. By understanding the sorts of loans out there, comparing lenders, and managing loans responsibly, borrowers can take important steps towards reaching financial restoration and stability. Remember, a personal loan can be a instrument for change, however it’s essential to method it with warning and a transparent plan for repayment.

No listing found.